Across the digital media and technology vertical, companies are constantly raising capital to expand and grow their brands. Whether you turn to TechCrunch, Recode, or other industry publications, it seems that unless you are raising a substantial amount of capital or are on your Series E investment, your company is not growing at a pace to attract the attention of potential acquirers. Recently, however, there has been a strong appetite from both corporate and financial acquirers to seek out and buy businesses that have been bootstrapped or never raised an outside round of capital. So what is driving this trend?

Platform Piggybacking to Scale

As the growth of technology-enabled companies continues to disrupt established incumbents, newer businesses have been fortunate to benefit from several trends enabling them to take advantage of network effects and grow quicker without the substantial capital investments that had been unavailable to earlier companies. We have seen substantial network effects occurring in the eCommerce and media sectors, where companies have been able to leverage the platforms of Amazon, Google, and Facebook to create scale with no outside investment.

These eCommerce savvy businesses utilize their infrastructure and digital expertise to monetize at a much earlier stage, while not having to invest the significant capital typically needed by traditional businesses to build the infrastructure required to get a business to scale. We recently advised two businesses which took advantage of the scale provided by larger digital platforms to grow without taking substantial capital from outside parties. Both companies created successful brands and utilized various platforms to scale their growth parabolically in a capital efficient manner.

[To read more of Brandon Quartararo’s thought leadership click here]

Rapidly-growing direct-to-consumer deodorant brand Native used Facebook as a primary customer acquisition engine, generating substantial ROI on each dollar spent, a strong driver for Procter & Gamble’s (P&G) acquisition thesis. We knew that the Native story and brand would generate strong excitement and acquirer interest while allowing P&G to broaden its existing portfolio of personal care brands, such as Secret, Old Spice, and Gillette by capitalizing on the direct-to-consumer and better-for-you positioning of the Native brand.

We have seen substantial network effects occurring in the eCommerce and media sectors, where companies have been able to leverage the platforms of Amazon, Google, and Facebook to create scale with no outside investment.

Bear Down Brands, a rapidly-growing developer and marketer of branded home, health, and wellness products, piggybacked on Amazon’s global fulfillment footprint to grow their business into a top 10 Amazon seller account within five years of launching their Pure Enrichment and Bentgo brands before partnering with a consumer product-focused private equity firm.

These are but a few examples of companies that decided to invest in their brands and marketing instead of overhead and infrastructure to realize significant growth and substantial outcomes for their shareholders. Had they raised millions of dollars from outside venture or growth equity firms, their outcomes could have been very different as it may have limited the interest of select groups and may have altered the timing and trajectory of an exit.

The Benefits of Bootstrapping

Many entrepreneurs find that raising capital is a rite of passage and bragging right, but the process can often be distracting and time-consuming – and may not necessarily create the expected upside value that many hope will come from adding significant cash to the coffers. While we understand many disruptive business models are near impossible to scale without investment (i.e., electric vehicle charging networks or other capital-intensive projects), we have found that organic businesses without substantial outside capital often have better business fundamentals and greater exit opportunities for the founders in the long run.

Some sample characteristics of companies that often generate significant acquirer interest include capital efficiency and cash flow generation; natural, organic growth driven by innovative business models; gritty teams with a strong management bench; and developed information systems and internal financial controls.

Creating Additional Optionality

Historically, digital media businesses had not been an area of focus for many traditional private equity and financial acquirers. However, over the past 24 months, there has been a sea of change in activity as traditional players increasingly look outside their comfort zone, driven by challenges in their usual sectors of focus, including retail, apparel, and traditional consumer products. The lack of growth, channel disruption and increased risk have forced many of these industry stalwarts to look at potential deals outside their normal strike zone with a particular focus on founder-owned, bootstrapped businesses.

[For more on Intrepid’s approach to Investment Banking click here]

Two recent examples of these trends include account-based marketing company Madison Logic’s acquisition by Clarion Capital Partners, which allows Madison to expand its data-driven product development efforts to a number of new verticals and geographic areas; and ICV Partners’ investment in LeadingResponse, a client acquisition and lead generation specialist that has approximately $70M in annual revenue.

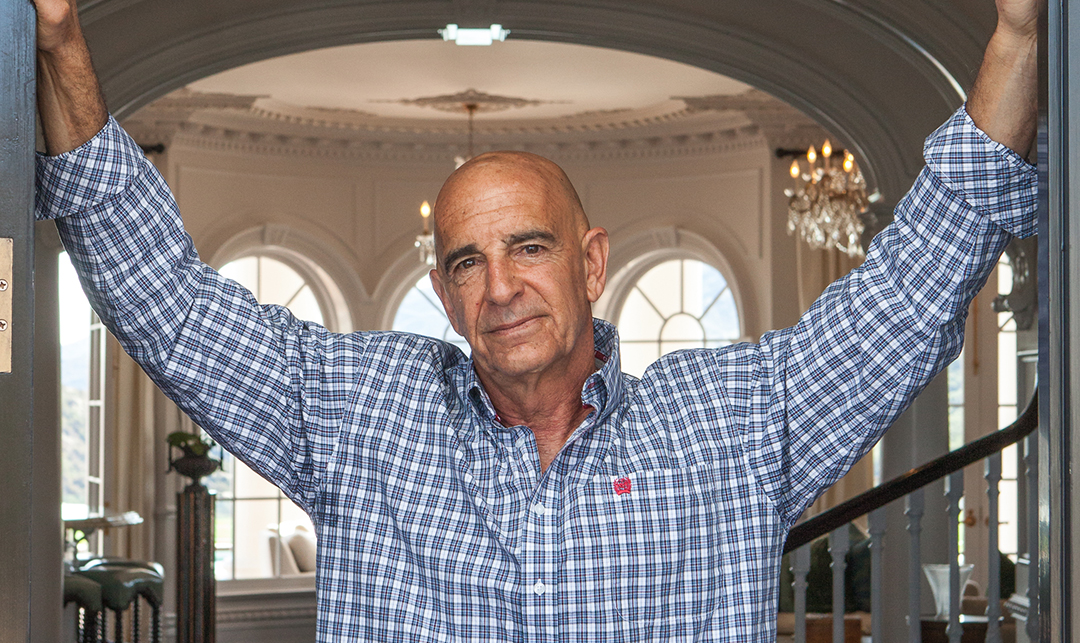

Digital Business Are Created to Sell

Early on in my career, a wise advisor told me that all digital media businesses were created to sell, not to become family legacies. With that in mind, creating a strong exit opportunity requires the right mix of financial strength, a solid management team and, most importantly, a wide audience of potential acquirers with the goal of creating a heated competitive deal environment. Having the proper business fundamentals and a broad addressable market makes a business attractive to potential acquirers. Balancing this smart fundamental-driven approach to company building will result in a positive outcome for shareholders over time and present ultimate optionality in the long run.