Despite previous concerns of overbuilding and prices topping out in major markets, the multifamily real estate market is thriving. Across the board rent growth, increasing prices, and low vacancy rates in most markets continue to whet the appetites of investors looking for a low-risk profile and solid returns. But the strength of today’s multi-family sector is driven by demographic transition as much as it is by improving economics. In fact, demographics may well play the greatest role in determining the vitality of the commercial real estate industry for the foreseeable future.

Generation Y (those born in the 1980s and 1990s) lives, works, shops, and plays differently than previous generations. Also known as “millennials,” today’s twenty- and thirty-somethings don’t share the same dream of suburban home ownership that their parents and grandparents had. In fact, many millennials find comfort in urban areas, preferring to live closer to work (if they don’t already work from home). They are far less committed to any one home or employer over the long haul, and place far greater demands on their employers and landlords in terms of the living and working spaces they wish to inhabit.

“Generation Y (those born in the 1980s and 1990s) lives, works, shops, and plays differently than previous generations.”

To respond to this, and to address the millennial generation’s desire for a greater sense of community, developers are looking at new ways of blurring the boundaries between a development and its surrounding neighborhood. As such, mixed-use development projects continue to command significant attention from real estate investors. Retailers are seeking new urban formats that can serve the needs of young city dwellers more efficiently. Evolving work habits coupled with demands for improved social amenities and hipper, repurposed environments are causing shifts in office investment strategies. The need by employees for more collaborative work spaces has resulted in employers reconfiguring less space per worker as they plan for future needs.

There is also the rise of hotel-like service that reflects more than the popularity of a new “feature.” Rather, it reflects an important step in the evolution of our understanding about the communities we build: Ultimately, it’s not “stuff” but experiences that matter. Millennials have consciously embraced that mantra in how they spend their time and money, and the developments that are most successful reflect that. The challenge in providing hotel-level service is the increased staff needed to do so. This, in turn, requires not just more revenue but more occupants, which means larger developments.

However developers choose to respond to demographic changes, they need to keep their focus on the big picture. How will their projects, in terms of the design of the residences and the quality of the retail, promote community building in the surrounding area? This holistic perspective may be one of the most powerful attributes of the current mixed use resurgence, significantly increasing the chances that the projects being built today will not only be economically attractive, but leave a positive legacy—and example—for the next generation.

As real estate developers look toward the future, the power of urban planning will become increasingly important. They must recognize that building a community where people want to live will more than pay for itself. Landlords can command a premium for a place people enjoy calling home as well as a higher rate of renewed leases.

“Numbering some 75 million in the U.S., Baby Boomers represent about 27 percent of our population.”

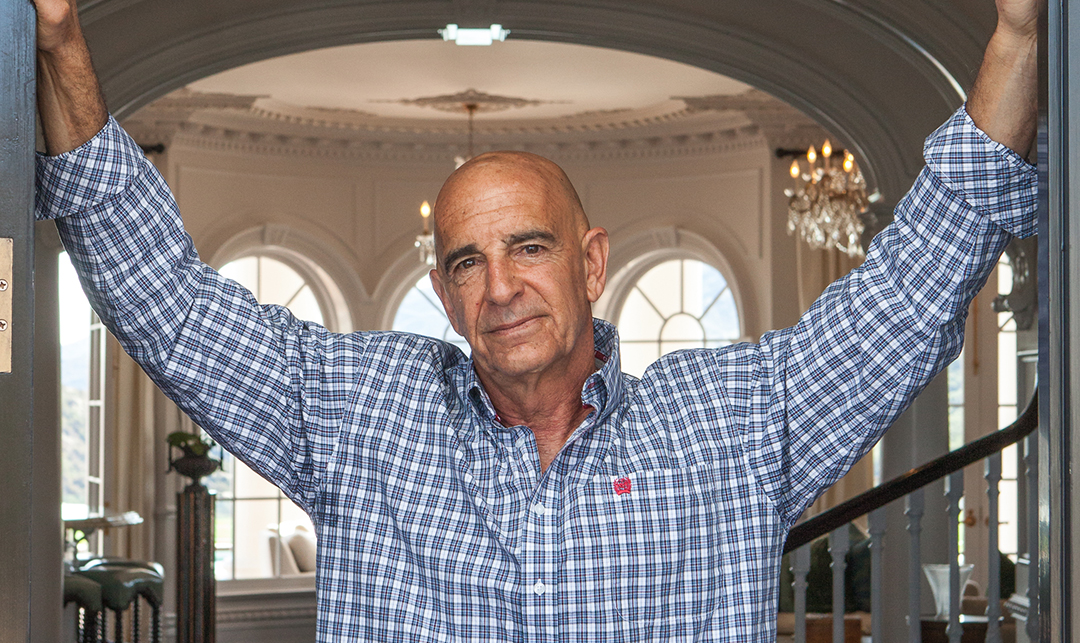

Finally, another demographic trend that is not often cited, but significantly impacting commercial real estate investment and worthy of mentioning, is what is happening on the other side of the generational span in the Boomer Generation. With the age of the leading edge of baby boomers now well into the early 60s, that well-defined population segment has become the single wealthiest demographic segment in human history. Numbering some 75 million in the U.S., they represent about 27 percent of our population. Since their investments are increasingly and invariably shifting to less riskier endeavors, certain sectors of real estate represent that ideal class of low-risk, high-performing asset class that will most likely continue to increase. Multifamily housing, for example, shows no signs of diminishing its growth trajectory in terms of fundamentals, property values, consistent rental increases in most markets, and a steady revenue stream for its investor base. The same can be said for the hospitality and industrial sectors. As a direct reflection of that trend, look for large pension funds, sovereign wealth funds, endowments, and insurance companies to steadily increase their allocations to real estate investment.