“To meet the energy challenge requires the most important energy of all: human creativity.” – Daniel Yergin

Over the last 20 years, society has entered into a self-propagating feedback loop of innovation and implosion brought on by waves of confluence between entrenched power structures and technological advancements. Some waves are slow moving like greenhouse gas emissions, slowly but surely worsening our storms and lengthening our droughts. Some waves are faster, like the tsunamic wave of economic volatility brought on by the novel coronavirus, a mercurial state not seen since the Great Depression, catalyzing a decade of technological and social advancement in mere months. What both surges have in common are untold riches for companies and institutions well-positioned to react to change—and paralyzed potential or even extinction for those who weren’t.

Increasingly, digital and decentralized business practices have led to an era of record-high productivity and reduced costs for those willing to embrace them. till, one of the most foundational pillars of the modern economy, the open exchange of commodities, functions nearly the same as it did upon inception, nearly 200 years ago, seemingly immune to the increasingly acute waves of innovation. Some in the world of commodities are ready to embrace foundational change for the betterment of society, while others are either pushing back with the full weight of their multibillion-dollar institutions or greenwashing sustainable finance as a rather insincere public relations initiative.

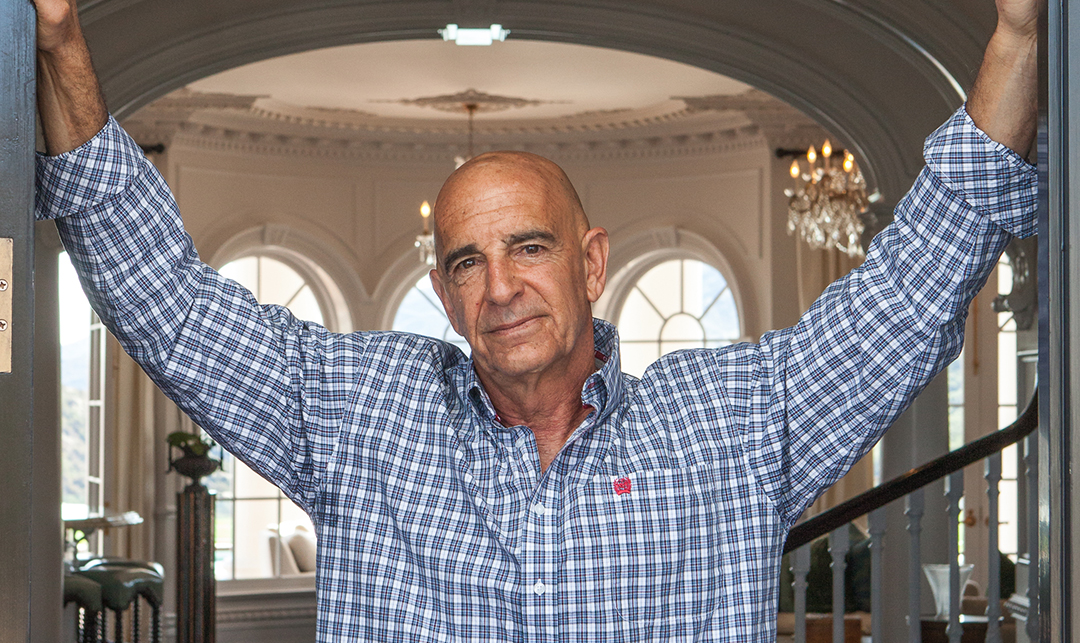

Enter Maryam Ayati. A leading energy and commodities deal maker, Ayati has been an executive at Royal Dutch Shell for more than a decade. She has led creation of several multibillion dollar ventures and business models in startup and corporate settings, including world firsts in LNG to mobility, LNG-fueled mining, flare gas to mobility, LNG-fueled drilling, and Royal Dutch Shell’s LNG to Downstream and Marine businesses, part of the launch team for the group’s New Energies business. Most recently, Ayati created and ran physical and business-model deal making across Shell Trading’s Global Crude & Oil Products businesses, as well as serving on the Downstream M&A executive team.

Ayati was co-founder of KomGo and Vakt enterprise blockchains , and founding board chairperson for the latter.

Today she’s co-founder and CEO of NEO Holdings (neo.co). Collaborating across giants of industry, trade and cryptography, Neo is building a world-first open blockchain ecosystem (layer one and exchange) with verified identities and ESG [environmental, social, and governance] provenance for physical commodity supply and trading. Neo calls this the Common Digital Protocols. Ayati was interviewed on an episode of the podcast Smarter Markets, with which CSQ has partnered to present the following conversation.

Let’s jump right in. Where do we stand in general, today?

Society’s expectations from the resources we consume and the upstream supply chains our consumption finances has evolved. Industry, trade, regulation, financing, … the whole of our supply chains are being redesigned as we build back better. This is the once-in-a-generation opportunity at the intersection of cryptography/digitalization, transparency and commodities. We believe these common digital protocols should be built by industry, consumers and tech, together in mutually owned, tokenized profit models.

Your life and career have taken you all over the world. What’s a key story from your life that you’d like to impart on our readers?

I grew up in Iran and my mother is a very fierce feminist educator. When I joined the oil industry in London with Shell, she sat me down and gave me one of the harshest talkings to she ever has, telling me the story of growing up as a little girl in Iran with an Anglo Persian oil company and the allocation of space and resources to expatriates versus local people.

Maryam Ayati hiking with her son. Photo courtesy Maryam Ayati.

Parts of the Caspian, which is our beautiful coast, were being allocated to expatriates only. The Iranians weren’t allowed—walls said it was for Anglo Persian oil company staff only. How could I possibly go into a world that perpetuates that outcome? For my mom, this was a deeply personal and important message to impart on me. By then, I had spent a few years across the former Soviet Union, working on human rights and trade. Having spent a very long time also working across Africa, the Middle East, and the Americas, I’ve come to understand much better the inequality she spoke of, the way hands dealt some 100 years ago created today’s concentration of wealth and centralized supply chains. Her caution on the human perils of perpetuating the status quo and seeing its consequences around the world—both good and not so good—has been truly fundamental in the way I approach my work.

And so I bring this lens here. For me, it’s an important point to drive home on how I look at the world and how many, many hundreds of millions of humans around the world interact with the output of our work as industrialists, providers of energy and resources. We look at the world and how might we engage with them in a conversation that designs a different future.

Now, you are a veteran of commodity markets and the design of the markets themselves, as well as having worked for more than a decade in the oil industry. What challenges would you foresee in terms of implementing substantial change in the way commodities are traded?

Change in how the markets price environmental and social impact is inevitable, but it’s only a stepping stone to a much more rapid redesign of the total system—the last hundred years and the way we’ve interacted with energy and extractives, as they bring to us the various resources and the electricity we need to live the lives we want and the lifestyle that we desired. So, initially, there were no consequences. There was no transparency. Frankly, no one seemed to care. And the supply chain was gray and opaque, which was OK then, as long as the magic of electricity, cooling, refrigeration, heating, and the prosperity it enabled was reaching a world starved for it.

Maryam Ayati and Robert Friedland at the Singapore Week of Innovation and Technology. Photo courtesy Maryam Ayati.

Over time, of course, we learned through actual consequences of being nationalized as an industry or being demonized as an industry that corporate social responsibility needed to be taken seriously. It became a sort of proxy add-on. We started building schools and hospitals and trying to do the right thing, but at minimum cost without disturbing the supply chain or impacting profitability. And so this concept of CSR [corporate social responsibility] was born, but it was still ad hoc, opaque, and location specific.

So if you were getting your oil out of Nigeria or out of Iran, then you worried about tackling those things so the government didn’t get upset. Over time, the environmental footprint of what we do has come to the fore and that’s also coincided with a much more engaged global population that can now start to see and opine on the subject. Whether they have all the right information or not is a whole other debate that I’m sure we’ll get into. But there’s a much broader group of stakeholders, buyers, sellers, governments, NOCs, governing bodies, and regulators who now have an opinion on what the environmental footprint of our activities should be—all the way upstream. So we invented offsets and it’s a beautiful approximation of, “Yes perhaps bad things are happening here, but if we do enough good things over there and you bundle them together, that’s a great outcome.” It’s not perfect but at least it aims to get us closer to neutral. And of course, when we’re tackling carbon offsets, we are increasingly working to incorporate other SDGs and bring in some of that social impact into it as well. But it’s still a disconnected model and it’s a model that needs to be matured.

I tend to believe there is a way to complement this model. There is a whole world of people coming at this dilemma from a completely different starting point. The aim is to build a new-economy version of this that probably will do its very best to compete with offsets and bundling. It will embody all of the attributes of a commodity, whether it’s social impact, environmental, or whichever sustainable development goal a consumer wants to prioritize in their consumption. This is a game changer.

Whether a specific commodity is virgin or recycled, whether it comes from a country where people don’t want to support some policy that the government has, or it comes from a country that seems to be embodying more of the universal values that people want to support—all of that will be priced into and tokenized into a singular representation of the resources we consume, buy, finance, sell, etc. And what we stand for in our consumption will be more transparent.

Tokenizing commodities so that you could use distributed ledger technology to create an immutable record of the history of production of these commodities is no small task. How quickly do you think this kind of radical change could be embraced by the broader market?

About three years ago, I sat in a room with 16 of my peers across commodity trading houses and super majors, alongside Shell—each armed with our antitrust lawyers and with many, many compliance folks. We wanted to figure out how we might take the noncommercial, operational aspects of our trading business, crude trading, to a blockchain platform that allowed us to create significant efficiencies—ultimately to benefit the customer—as well as using newer tech to reduce fraud by going digital and going on a blockchain.

And so, in 2017, we were able to have that conversation across the major commodity houses, which led to the creation of what is now Vakt, with most of the North Sea crude traders around the table as investors or users of the platform. Then, of course, the industry is ready and of course the industry understands how we might use blockchain technology as a proxy for trust. That’s a very important thing, because we don’t trust one another and we have no intention of trusting one another. We’re competitors and fiercely competitive in the commercial space.

So the future lies in the ability to create space to do the things that data and digital require of us in a system where trust is replaced by the ability to verify and ensure an immutable version of the truth. One of the world’s first enterprise-grade blockchain platforms was launched to 67% of the Brent trading market using it in 2019, created, backed, and used by industry.

So, of course, we’re ready.

The dilemma, however, is how much of our time, energy, and resources are we going to use to create digital replicas of what we already do today? In many ways, this is shortsighted and misses a significant opportunity. A more interesting conversation starts by looking at what is possible. What has technology made possible? What is the crypto world making possible?

I’m not talking about Bitcoin. I’m genuinely talking about creating from a clean slate, digital KYC-AML [know your customer–anti-money laundering], digital identity for all of the activities and nodes and resources that we consume, touch, or undertake today. That’s not far-fetched. The tech is ready and the infrastructure is already in play at the billions-of-dollars scale. Its inventors and innovators are just not always in our sphere of understanding or knowledge.

So how might we take that lens of the future and build back from a view that’s more informed by what is possible and less constrained by what has always been done? The status quo is the killer of innovation.

Transforming the ways commodities are priced and traded is a lofty goal, but as you stated it is just the beginning of something greater. Where is this ultimately headed?

I often talk to activists and environmentalists and people in the crypto space and people in the decentralized finance space, each of which are immense, immense economies of their own. In that world, our version of how things work is incredibly old school and dated. They have already created and curated much of what could become—should become—the base layer for transparent commodities and trade. It is possible today to build a quantitative and verifiable origin-to-consumption narrative for every resource we consume. This narrative forms a new grade of each commodity and can be incorporated into a single identity token, tokenized and traded.

Now imagine that level of transparency and what it does to an economic market, what it does to a traded market. That ability to see as a consumer, as a buyer, as a seller and trader, to be able to share and see all of that history, create new grades of commodities on the back of the ESG attributes they embody, and let the market decide what it’s worth.

I have a good friend in Singapore whose organization is working very hard to put a price on every SDG [sustainable development goal] that the UN has created by looking at the way the markets have valued, the voluntary carbon markets historically, how they have valued various offsets and how each valuation links to a specific SDG, what pattern that tells us about the market’s perception of “good”. It won’t be long before we can price that into the value of every single commodity and let the market—retail and B2B participants—decide what each attribute is worth. History need not be our only source of insight.

It goes further than the customer’s appetite. Tokenization allows for ESG attributes to be defined in granular, decentralized form with each attribute feeding the financial mechanisms in the market, regulatory and compliance. We can put all of that in a single digital representation of a resource that I use as an individual, as a business, or as a city. The market I describe is a fundamentally different one than one that has a traditional supply chain and offsets.

Let’s face it, how ready is the industry to adopt the kind of change you’re talking about?

When the Rockefellers or the Shells or BPs of this world were going around a hundred years ago, acquiring the reserves that laid the foundation for a century of wealth and progress and innovation, no one governed them truly. And no one understood the consequences of this land grab while it was happening.

So, in the same vein, can the commodities world ignore the fact that there’s a bunch of very smart newcomers sitting in offices in places far away from energy and mining C-suites laying the common digital protocols of a future that looks very much like I described?

If the answer is, “Yes, we’ll ignore it.” Great. There’s immense opportunity to continue to iterate in the status quo until it becomes irrelevant.

But there’s a further and much more impressive opportunity today to collaborate with these newcomers, to bring them to the table with the giants, the resources, the footprint, the learnings, and the collective wisdom of the energy and commodities industry so that our world navigates, understands, and tries to design this next system better, to build a future to live in with the collective wisdom of these unlikely cohorts.

The greatest opportunity lost will be to sit back as an industry that has gone through so many years of learning and not show up for this next iteration.

Our prosperity as an industry has come with significant lessons learned and it comes with infrastructure, distribution channels, and an understanding of what it actually takes to turn a dormant resource in the ground into a commodity to utilized. We have sophisticated mechanisms for how it must be governed to have better outcomes than we had at the onset of the fossil fuel industry and the extractive industry.

So those learnings and those resources and those assets and distribution channels warrant a critical seat at the table with the data scientists, with the environmentalists, with the tech giants who are sitting in front of our legislators and lawmakers, arguing and debating the compliance and governance framework that will govern how we do this future business.

What are some of the other benefits that you see to a tokenized, commodity-trading infrastructure to replace the futures markets that we have today?

There’s a whole incentive mechanism that comes into place when we talk about the crypto and the tokenized version of the world, which is about the elimination of waste and its direct link to prosperity. I know that sounds potentially fluffy, but it’s incredibly important to remember how much of the energy we need to fuel the global growth forecasted is wasted today.

So the ability to eliminate waste in our ecosystem is an incredibly powerful source of new energy. We talk about incentivizing the upstream in all forms, whether it’s mining, extractives, fossil fuels, and augmenting solar, augmenting wind with the right battery technology to store them, etc.

There’s also a much more readily available opportunity, which is the elimination of waste. And the elimination of waste I want to talk about in terms of an individual, a city, as societies, our footprint, and resource intensity of that footprint, from a day-to-day series of activities and how that might transition to a far less resource-intensive one, if all of these activities were priced. And it’s an inevitable outcome. Once you put a price on waste through this footprint analysis and origin tracking that we just discussed, then I, as a consumer, will be directly incentivized to turn off my light, to do my laundry at a certain time, to get rid of my 5.7 liter V8. And to do the things it takes to lower that bill. If I care, and many people won’t. But then the city and the governance models on top of that will care. And we can work in ways to manage resource allocation in a much smarter and sharper way, which will send the right signals to the market.

Because if, repeatedly, Amazon or Apple or the City of Los Angeles decides to put in all of its RFPs and all of its acquisition of power, or even waste management or construction, various metrics that require an understanding of the origin and the supply chain of the materials and resources brought in, the markets will value that. The markets will value it all across the supply chain. And much of the wasteful cheapest stuff will start to disappear and will save resources in a very different way than we have before.

The other thing that I think will be interesting to watch is how the developing world and the economic South embark on their own version, on their path to prosperity. Whether they will go down the path of a more wasteful version of it like the UK or the US, or whether they’ll take a more Japanese model where GDP growth per capita doesn’t coincide with that same spike in wastefulness and sprawling footprints per capita.

Photo courtesy Maryam Ayati.

And so as Africa, as China, as India decide how to proceed to prosperity, having already leapfrogged brick and mortar in so many activities and processes, all of it will be priced in. All of it will be priced in and the markets will be able to see that live and react to it in a way that’s much more immediate than signaling for corporate social responsibility or signaling for more forests to be planted. Both of which need to be done, but this will be a much more immediate and transparent feedback loop.

Imagine being able to drive into a gas station and scanning to see the footprint and the legacy of the molecule you’re able to put into your car. Now, you might not care, but clearly, all the guys and girls who get on airplanes, and I appreciate the irony, get on airplanes to go protest in front of hydrocarbon and extractive industries, would. And that’s a huge portion of the population who would then be able to scan at a moment and see the footprint of the things they are about to pay for. Would you drive across the street to a different gas station where the supply chain gives you cleaner fuel? I would dare to say, yes. Will the market value that? Absolutely.

That’s why we’re seeing organizations like BP under Bernard Looney’s leadership, talk about reinventing a fundamentally different way of interacting with their supply chains and with society. Why Shell has for years quietly but decidedly done the same thing. Why so many of the giants who bring these molecules to life, understand and fundamentally are engaged in a different supply chain. Because it is becoming transparent. Because it is becoming valued. Because it’s the right thing to do. But it’s also the most profitable thing to do.

If we’re talking about designing new markets, the people that are using the current markets I think reasonably have a say in how that should happen. How do they get their chance to have their voice heard?

That is really the heart of what I spend most of my time thinking about and engaging with many smart people around the world, because many of the established industries are building forward from the past, as a step-by-step approach. There’s a real risk that we create unintended consequences by ignoring what we don’t understand., by ignoring conversations and rooms and protocols and land grabs, the language of which we don’t understand. The rooms into which we don’t have a doorway. And ones that fundamentally do challenge existing vested interests in the supply chains and distribution channels that industry has created and curated, made efficient and profitable over a hundred years. So that closed system and that desire to preserve value and drive for efficiency, which is the definition of a corporate or any organization, is driving efficiency to milk the infrastructure for even more value. The consequence of that is ignoring an unclear, emergent version of the world because we simply don’t understand it.

There is a genuine opportunity in a brain trust and active process of engaging the energy, mining, shipping, agri, etc,. executives who are at the tip of the spear of thinking about this. If you’re thinking about LNG [liquefied natural gas] and how that might genuinely become a bridge to a future economy, or we’re thinking about bundling that with offsets and we’re thinking about telling great stories about those offsets, there’s probably an equally important conversation to be in that says: What if all of that was done in one place with more transparency?

And what if we brought that wisdom and that ambition into a room that includes others who aren’t today invited? Who should they be? They should be the guys and girls building the decentralized version of our world.

And when I talk about the crypto version of the world, I don’t mean Bitcoin. Bitcoin did an amazing job of establishing a model of currency that exists outside of the centralized systems. But on the back of that, many, many new representations of currencies, assets, and resources have become part of a daily traded system that buys and sells these tokens as a genuine representation of real-life artifacts, nodes, resources, activities.

So that version of the crypto world is built on sophisticated and complex tech and data science with the potential for an incredibly sophisticated compliance mechanism—some of which blows my mind, having come from a commodities-trading, regulated environment, where I was sure we understood all the opportunities, and sitting in some of the conversations I do now with the crypto world and understanding how they are redesigning compliance and governance for the very same commodities that we were tackling in my previous life.

That’s incredibly powerful and we should at least understand one another’s language and one another’s strategies and help to create a better common framework for what will be the common digital protocols on which future trading will be built.

The other people who do warrant a seat at the table are the activists. Much of activism is focused on processes and commodities that the activist doesn’t necessarily understand the provenance of. The truth is that if I use a laptop today and then go and protest against an oil company or a mining company, I have no moral high ground. Because my whole lifestyle is reliant on the hard work of these men and women all around the world to get this to me. That activist community warrants being engaged even if only to make sure we’re talking about a common version of the truth, so that the legitimate concerns are integrated into a redesign and the ones that are based on a lack of understanding are alleviated through communication.

I find fascinating how much of our day-to-day activities is being outsourced and thereby monetized by tech giants, while we focus as a society on trying to clean up and restructure the previous version of centralized systems we put into place.

What do I mean by that? I mean, A hundred years ago, we created titans and giants sitting out of various offices around the world who governed the wealth of nations and their resources and monetized it. And now we’re trying to work through the good, the bad and the ugly of that as we bring ESGs to the fossil fuel and extractive industries. The same thing is happening with the tech giants, as they start to intermediate our interactions as a society, as a market, and as companies with all the activities we used to be able to access just by walking into a store, walking into a bank, calling someone on the phone. If we don’t engage in understanding what it is they are building, trying to both learn from that and influence those outcomes, for a more decentralized version of the future, we’re just handing the baton over to another set of titans and it won’t be the consumers or the commodity traders. It won’t be the extractives. It won’t be the miners. It’ll be a whole new set of titans.

And so our raison d’etre as an established industry perpetuates, if we’re able to take our learnings from the past, our infrastructure, our understanding of how markets work, our ability to deliver a supply chain safely, compliantly, and with mindfulness to both reliability and security, but bring that into this new economy. A new economy that is being designed right under our noses, but without our participation. That’s where the opportunity is.

This article was transcribed from a podcast conversation between Maryam Ayati and Erik Townsend from an episode of Smarter Markets by Abaxx Technologies (abaxx.tech). To listen to the conversation in its entirety, visit smartermarketspod.com.