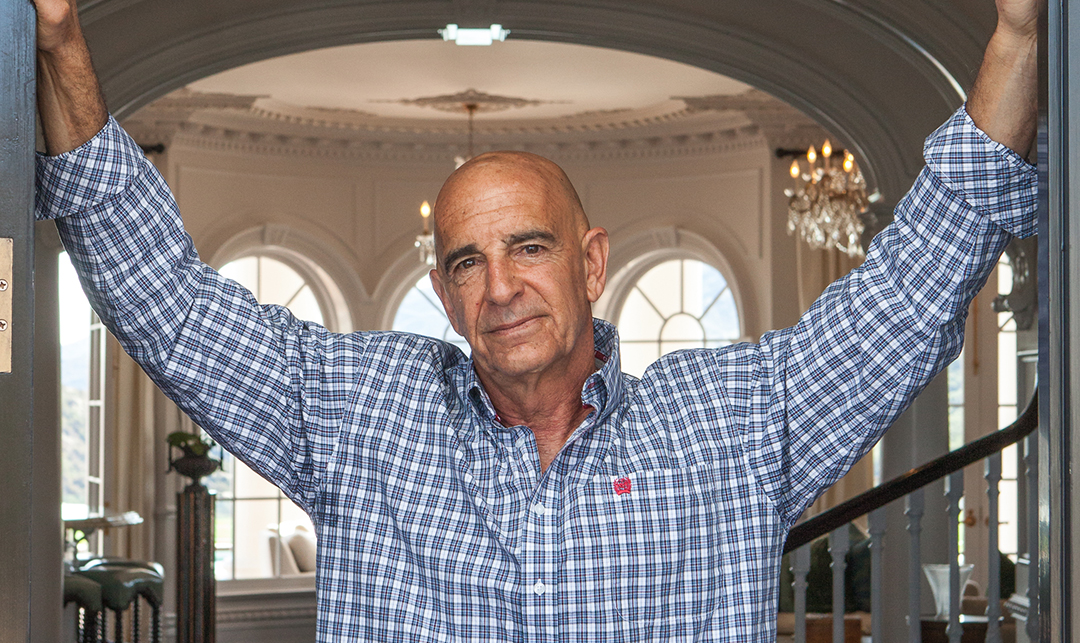

There was never any question in Therese Tucker’s mind that she would one day attain the entrepreneurial success she is now enjoying with BlackLine, the cloud accounting automation software company she founded in 2001. She is a little surprised, however, that “one day” took so long to arrive.

Speaking with CSQ in early January, little more than two months after an IPO placed BlackLine’s market cap at $1.5B, Tucker’s self-assuredness comes naturally. Her reference to the “ridiculous amount of confidence” it takes to be an entrepreneur is neither abrasive nor smug.

Then again, when you grow up on a farm in rural Illinois as one of four daughters—and no sons—you understand early on that there is no job that a woman isn’t fit to do. “On a farm, everybody works,” recalls Tucker of her upbringing. “We changed snow tires, we drove tractors, we fixed plows. We did all of the things that sons would have done.”

On her way to becoming the first female founder and CEO in Los Angeles to take a VC-backed startup public, Tucker invested her life savings, took out a second mortgage on her house, liquidated her 401K, and maxed out all her credit cards. She is especially mindful of those who floated payroll loans when customer checks did not arrive in time to fulfill payroll obligations, or mentors (such as Greg Pond, former CEO of financial software company ADS and Tom Unterman, partner at Rustic Canyon Partners) who helped support the company’s continued operation through challenging periods. “Without all the help I’ve received, nothing would be here,” Tucker acknowledges.

Tasting the Apple

As Tucker’s parents saw it, getting a respectable job as a secretary or stenographer, and finding a husband were the appropriate steps for their youngest daughter to graduate from life on the farm. Therese felt differently. She wanted to go to college. So off she went, to Illinois Wesleyan University, a small liberal arts college, where she became a business and French major.

In her sophomore year, Tucker noticed that a computer science programming course in Apple Basic was being offered. “It was after my chemistry class, right next door,” she recalls. “I took it out of laziness.” Her passion was instantly ignited. “I absolutely fell in love with programming,” says Tucker, marveling at its complex simplicity. “To this day, it’s the most amazing thing. You get the opportunity to write a list of instructions and then the computer does what you tell it to do. That’s programming.”

She transferred to the University of Illinois, known to have one of the top computer science programs in the country. Though she graduated with a degree in computer science and math, Tucker was not a dedicated student, acknowledging she did just enough to get by.

Tucker’s underwhelming academic record didn’t exactly dim her expectations of landing an ace programming job with a top employer of her choice. After visiting her sister in California, she decided she was going to come work for a company based on the West Coast that would happily cover her moving expenses. She received multiple job offers, ultimately accepting a position with Hughes Aircraft.

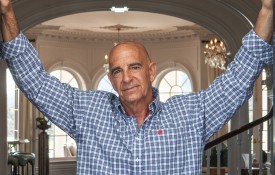

Tucker ringing the Nasdaq Opening Bell on October 28, 2016

Her job involved fault detection firmware for surface ship sonar, but Tucker soon felt the tug of bigger aspirations. She decided she wanted to be the next Bill Gates. “I quit my job, and without a dollar, without [practical knowledge of running a business], I started doing independent programming for different people,” she says. “It’s interesting, because if you have no money and you’ve quoted a fixed bid on programming something, you get to be a really good programmer when you don’t have any food.” As she continued to ramp up her abilities as a programmer, Tucker realized she was not nearly as efficient on the business side of her enterprise.

In the meantime, she met her husband-to-be, moved to Southern California, and became pregnant with her first child. Starting a family hastened the need for Tucker to take a real job, preferably one that offered insurance. She was hired in 1989 by ADS, a financial software company with about 60 employees. After verbally accepting the offer over the phone, Tucker went into the office and informed her potential employer of her pregnancy. “It was a hard thing to do, because I really wanted that job,” she says. Appreciative of her honesty, the company honored its original offer. Tucker would remain at the company for more than 12 years, gleaning insight along the way that would prove invaluable to her future entrepreneurial pursuits.

Tucker gained expertise in the art of commerce at ADS, learning the inner workings of a small, successful business operation. In 1997, the company was acquired by Sungard Treasury Systems, and Tucker was tasked with performing due diligence on acquisitions. “It was an amazing learning experience,” she says of the acquisition process. “How do you acquire another company?” she asks. “You don’t use osmosis; you have to go through it a few times.”

“It’s a massive distraction from the business. It’s a ton of work [and] the day of the IPO is the culmination of all that work. I compare it to a wedding. It’s a great day, but it’s one day only”

Finding Equilibrium

As her career progressed, Tucker saw her duties shifting increasingly from doing (programming, logistics) to talking (meeting people, managing relationships). She was promoted to CTO, and while her efforts were being rewarded, there was no semblance of a manageable work-life balance.

It all came to a head one morning while she was getting her daughter ready for school. Tucker was rushing around the house, absorbed in the proficiency of her multitasking prowess when the first-grader looked up at her and said, “Mom, I’m just so stressed!”

Her daughter’s words were a sobering epiphany for Tucker. She didn’t need to work; she could essentially retire and live comfortably on her savings. “I turned in my resignation that day,” she says. Dissuaded by her children from being the cookie-baking, carpooling parent volunteer that she knew she could be, Tucker instead “did a lot of yoga, got in great shape, and started getting really bored.”

Retirement at 40 was not working out for her. In the midst of her boredom, Tucker noticed that her wealth manager’s tax planning software was not very good. “I said, ‘I can write something better than anything you’ve got.’”

At that point, she sat down and wrote the software that became the origin of BlackLine.

It was June 2001 when Tucker incorporated what is now BlackLine. To wit, Tucker offers a rhetorical couplet: “Are you in the black? Are you above the line?”

As the company found its footing, at the request of a client (First National Bank of Nebraska) in 2004, the focus shifted from wealth management software to physical accounting software to automate the complex account reconciliation process. But the future was in the cloud. In 2005, Michael Baker Corporation, a small firm based in Irvine, Calif., approached BlackLine looking for a hosted accounting solution, as they lacked the IT resources for a dedicated, in-house department. By the end of 2007, BlackLine had begun a full-scale transition from physical software to on-demand, hosted, subscription-based software (or SaaS; software as a service).

Tucker on stage in November at “InTheBlack 2016,” BlackLine’s annual User Conference at the Westin Bonaventure in Downtown Los Angeles.

“SaaS software was easier to contract for, because it’s typically a smaller amount upfront,” Tucker explains. “It’s easier to implement because we don’t have to wait for [customers] to order equipment [and] there’s no danger of them screwing up their OS. We control that.” She offers additional reasons the shift to SaaS was a sound business decision. “It’s easier to support, easier to do upgrades, easier to roll out new functionality,” she enumerates.

Fork in the Road

Eventually, the company needed to choose a path. “We finally got to a fork in the road, and we couldn’t focus on both [hosted and non-hosted software] anymore.” BlackLine made the bold decision to shift to account reconciliation software in 2004, becoming one of, if not the first companies to do so. In comparison, the decision in late 2007 to focus on the cloud was a genuine risk. Tucker knew that older, large traditional companies would be resistant to the cloud due to perceived security risks. But she figured change was inevitable and some would be quicker than others to embrace it.

Being a woman never felt like a disadvantage to Tucker … quite the contrary … in tech, science, and finance, a female candidate continues to stand out prominently in a pool of predominantly male candidates.

In retrospect, BlackLine’s timing for this fundamental transition couldn’t have been more prescient. When the recession kicked in a few months later, capital budgets dried up. With a smaller upfront cost, SaaS became more attractive to companies suddenly constrained by shifting financial realities. Customers could try it, and if it worked for them, they could expand in other areas of the business. Organizations benefitted by avoiding the sizable upfront costs of an internal system in favor of a cloud-based service and BlackLine benefitted by having an ongoing flow of monthly subscriber revenue for a service as opposed to a one-time purchase of a product. In other words, Tucker emphasizes, “We make software, not shelfware.”

As it happened, the economic downturn was a boon for BlackLine. “The recession was a huge help in growing our business over the long term,” says Tucker. As the technology has evolved and the business seeks to keep pace with the rest of the world, an increasing number of large corporations who once said they would never go into the cloud have become receptive to SaaS. “This is where the future is,” affirms Tucker. Tucker’s affirmation has been corroborated – a 2016 Cisco white paper noted that “in 2020, 74% of total cloud workloads will be SaaS workloads, up from 65% in 2015.”

Renewed Vitality

In 2012, having built the company to sustainable success, Tucker found herself starting to feel a bit tuckered out. “I was considering selling it off and retiring again,” she confides. “I started a process, then decided along the way that I didn’t like the strategic buyers that came to the table. I thought they’d ruin the company.”

Her excitement began to build as she mulled it over. “There [was] still so much room for growth in our market,” says Tucker. Rather than selling, Tucker looked into taking on an equity partner “to see where it would go.” Silver Lake Sumeru, the mid-market, tech-focused fund of global VC giant Silver Lake, ultimately won her over. “I liked the people, they fit our culture; but on top of that, they did more due diligence than anybody else. They seemed like they would be good partners.” In August 2013, the firm invested in BlackLine, valuing the company at more than $200M. ICONIQ Capital also came on board as an investor at that time.

Tucker’s instincts about Silver Lake Sumeru were right on, but she was not expecting such an immediate impact. “We scaled business up to offices in 10 or 11 countries very quickly,” she says. We also hired a whole C-suite [of company leadership],” she recalls, telling her investor: “Let me let them get things in place to scale for the long term and then we can discuss where to take this next.” On October 28, 2016, BL (BlackLine) was offered on the Nasdaq Global Select Market. “We were at Nasdaq, ringing the bell,” Tucker recalls. The stock climbed steadily throughout the day, closing at $23.70, more than 40% above the $17 at which it was priced the night before.

“I’m so glad it’s over,” she says of the IPO process. “It’s a massive distraction from the business. It’s a ton of work [and] the day of the IPO is the culmination of all that work. I compare it to a wedding. It’s a great day, but it’s one day only.” Going public did not alter BlackLine’s corporate philosophy: Accountability to shareholders was considered equivalent to the accountability owed to employees when BlackLine was a private entity. The same

rules applied. “We’ve always been accountable to employees and previous investors,” Tucker says.

“People think when you’re starting a company, you’re insane. Until it does well … then you’re brilliant. The reality is, I failed over and over and over and over until I didn’t.”

Therese and her BlackLine team onsite working with Habitat for Humanity, one of the company’s charitable passions

Raising the Bottom Line

Several years ago, Tucker accompanied her daughter to distribute food for the homeless in downtown Los Angeles. Genuinely touched, Tucker made regular trips back with her daughter and gained a sense of appreciation for lending her assistance to humanitarian causes.

In 2014, Tucker was invited to join the California Community Foundation (CCF) Board of Directors. The organization has been entrusted with more than 1,600 funds, with nearly $1.5B in assets. “I’m super proud of that organization,” she says. “They do amazing things with many different charities, [such as] helping them apply for grants, getting sustainable, coordinating, pushing money out—all in the name of improving the quality of life for all of the residents of LA.” Her husband, Brian, is also an advocate for the homeless and sits on the board of PATH (People Assisting the Homeless), a charity based in downtown LA.

Tied into BlackLine’s corporate philosophy, Tucker says, is the desire to hire genuinely good people. “Typically, nice people have giving hearts,” she explains. Employee participation in various fundraising drives and events is a regular occurrence, whether it’s picking up trash for a beautification project or volunteering for Habitat for Humanity.

Today, Tucker carries the torch for female tech entrepreneurs everywhere, embracing her role model status. She speaks regularly at women’s events and LA-area schools, promoting female involvement in the tech and finance sectors. “There are very few women in computer science,” she says, “and having more women in the financial world is important for girls growing up.”

Now that her children are grown up, balancing life and career is much less of a strain to maintain. She can travel when she needs to, which usually means business-related trips to Australia, Singapore, Europe, and various U.S. destinations.

Being a woman never felt like a disadvantage to Tucker; quite the contrary. In tech, science, and finance, a female candidate continues to stand out prominently in a pool of predominantly male candidates. She hopes one day the glass ceiling will be shattered and the stereotype will fall by the wayside as more women discover the wealth of opportunities in these fields.

It comes down to whether you’re setting limitations or expectations for yourself. “People think when you’re starting a company, you’re insane. Until it does well,” she says. “Then you’re brilliant. The reality is, I failed over and over and over and over until I didn’t.”